Back in May, Search Engine Watch asked me to write a piece about alternatives to Google. This research was enlightening. It gave me another perspective on the search industry across the global context and how it varies from market to market.

This has prompted a series of more in-depth posts which have helped me speculate how search – even within the Google framework – may well evolve over the next few years. My piece on Ecosia looked at the environmental cost of digital activity and suggested that we might see search leaders work to be more transparent about the ecological ramifications of everyday internet activities right down to individual searches. A subsequent piece on DuckDuckGo celebrated the search tool which puts user privacy before sellable ad data – a USP which is all the more valuable as growing numbers of internet users get tired of creepy online tracking and privacy breaches.

Today we look to Baidu – China’s leading search engine.

The ‘Google of China’

According to Alexa, Baidu is the fourth most popular website globally (behind Google, YouTube and Facebook). StatCounter indicates it currently reaches around 70% of search engine users in its home country. That’s a whopping 448 million people if we base user numbers on the latest CNNIC report.

Baidu’s similarities to Google are plenty. It dates back to the 1990s, boasts a range of digital products and is currently leading the charge in AI development and self-driving cars. But it is arguable that while Google dominates search in the west and looks likely to continue doing so for some time, Baidu’s dominance in China during 2018 has looked somewhat less stable.

Let’s look at why.

China is mobile

By the end of 2017, there were 772 million internet users in China according to CNNIC. To give us some European perspective, that’s more than the whole of our continent. For US audiences, that’s around double the amount of netizens in North America.

The really important fact, however, is that internet use in China is overwhelmingly done on mobile. Again, the CNNIC reports that 97.5% of Chinese internet users are going online via mobile devices.

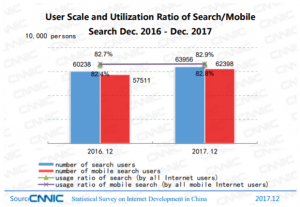

It is in the mobile context where most searching occurs in China and, crucially, growth is still significant. Between December 2016 and December 2017, mobile search user numbers grew 8.5% and reached 624 million people.

Baidu is losing share

Baidu boasts a perfectly functional mobile search offering, but there have been a number of new companies entering and disrupting the market in recent years. Unsurprisingly, this has caused Baidu to lose share.

Since August 2016, Baidu’s mobile search share has fallen from 87% to 69%. Other well-established domestic search engines Sogou and Haosou are having an impact. But most of this land grab has been won by Shenma, a relative newcomer to China’s search scene. Since being founded in 2014, it has grown to account for 21% of the market.

Shenma: China’s ‘mobile only’ search option

Shenma’s unique selling point is that it is only available on mobile. But the companies who are behind the tool are certainly very visible across Chinese desktops and laptops too. Alibaba is the umbrella conglomerate under which such brands as Taobao and AliPay sit, while UCWeb is the internet company which owns UC Browser, the third biggest browser in the world.

The influence of both of Shenma’s parent companies is quite obvious when we start to look at the functionality of the service. In the first place, the tool is very geared towards shopping, with app purchases as important to the model as physical products, alongside local search and a unique ‘novel search’ aimed at users who enjoy reading books on their devices.

Shenma has also been able to leverage the market presence of UC Browser – the search engine included in its mobile offering – and goes some way to explaining the success of the young company in the face of such stiff competition.

Can Baidu respond to Shenma’s advancements?

While Shenma still lags some way behind Baidu in search share, it is clearly doing something right by providing a service which is tailored precisely to the needs of China’s mobile audience, and its growth goes to proving that. In order to respond, Baidu perhaps needs to do more to reverse-engineer its already well-established search tool to be even more mobile-centric. That is, to make it less desktoppy and more geared to on-the-go searching and the capabilities of the mobile devices themselves.

In some ways it is doing this. Recent news from the Baidu Video arm of the company has seen a fresh round of investment totaling $100m. In light of this increased funding, one of the aims now is for the business to become the biggest professional generated content (PGC) video provider in China. Another aim is to develop its short video services, which will further see it appeal to viewers watching this content on mobile devices.

Is Google set to re-enter the fray too?

Shenma isn’t the only threat to Baidu’s hold on the Chinese mobile search market. Google has spent 2018 negotiating with key digital companies based in the country, including a patent cross-licensing agreement with Tencent (owners of QQ and WeChat) and a partnership with e-commerce company JD.com.

These deals preceded the very recent news that Google is also gearing up to launch a mobile-centric search platform in China which links mobile phone numbers to search terms and plans to adhere to the country’s strict censorship laws. Despite criticism being leveled at the company from some corners, a poll from Weibo indicates that there is a healthy appetite among a majority of Chinese netizens for Google to enter the market since the search giant was banned in 2010.

Perhaps the expectation that Google will return to China with their new partnerships, their mobile-specific tool, and their already leading mobile web browser (Chrome is the most popular browser in the country, as it is worldwide) leaves Baidu little choice but to look elsewhere in their development and evolution. Its plans to push its video offering may suggest this. Mobile video is a growth sector in China too – and their position in that vertical may be more solid.

Another theory may simply be that Baidu is awaiting Google’s return to see how this affects the domestic search market at large. After all, it is likely that the next year or so will not be plain sailing for Shenma either if Google’s mobile search platform arrives and disrupts the market again. One thing is certain, though: mobile search in China is fascinating – and I think it could take some surprising turns in the not too distant future.

from Search Engine Watch https://ift.tt/2OTQNHC

No comments:

Post a Comment