WebProNews

Commercial Real Estate and its Altered Path

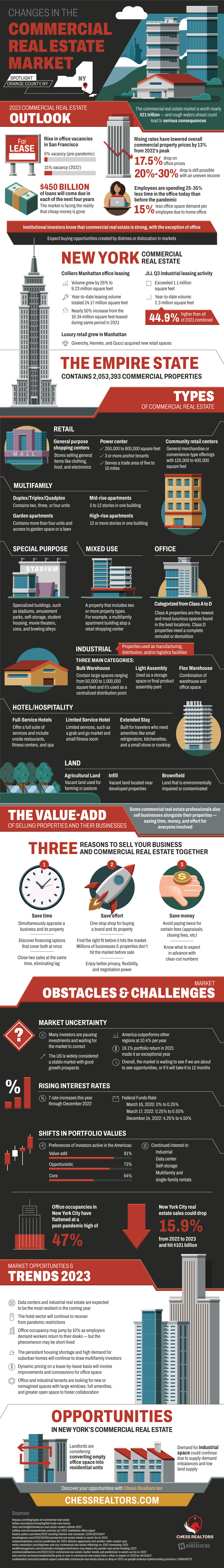

Countless industries and areas of life saw change varying from small tweaks to entire destruction following the pandemic. One very broad industry that saw a lot of change was that of real estate. The pandemic exposed the absolute necessity of some buildings and forms of real estate while others started to dwindle. The market today is worth trillions of dollars, but with bumpy waters ahead it’s hard to say exactly where it will end up.

What’s Happened to the Office

At the heart of the change to real estate is the changing role of office spaces. When one imagines a place like New York there’s nothing more prominent than the countless skyscrapers. Historically, many of these buildings, if not have a majority, have been a form of office space. There are many types of commercial real estate, ranging from retail, to multifamily, to special purpose, to office space. Office space in particular is seeing a unique drop in prices and vacancies.

In San Francisco, for example, the vacancy rate has gone up nearly 10% from pre-pandemic to 2022. All across America people are spending less time in their office, amounting to a 25% to 35% drop. This has created a 15% drop in demand for office space, something that, in cities like New York, has been devastating. Office occupancies, not vacancies, have rested at a 47% high in New York. The majority of office spaces are vacant and it’s hurting the industry in New York badly.

As 2023 continues, New York real estate sales could drop 15.9% from 2022. This just goes to show how devastated at least one region can be by the pandemic changes. Although this is not to say that all aspects of real estate are in danger. Housing, for example, is actually ever in demand. It’s actually so in demand that landlords in bigger cities are considering turning vacant offices into residential units.

Multi-family homes, a type of commercial real estate mentioned briefly earlier, is also incredibly in demand. While apartment complexes are fairly common, the demand for suburban homes continues to grow year after year. Hotels are interestingly also on an upswing, likely due to the dropping of pandemic restrictions over time.

Commercial Real Estate’s Resilience

Two of the most resilient industries in modern America are data centers and industrial real estate. Industrial land is in demand with very little land being sold that can house such large facilities. This means it’s one of the few parts of real estate that actually are in a low-land high-demand imbalance. Industry is something that only grows with the population and in a similar manner to housing it continues to grow in demand.

Data centers on the other hand are a byproduct of the modern technological industry. Tech has rapidly become one of the most fruitful areas of investment and it’s not a secret. Data centers are still being created rapidly to account for the rapid influx of corporations that rely on them. This is still challenging, as is industrial real estate and more typical housing.

In Conclusion

Today, interest rates are up, investors are scared, although the market is still thriving. It’s an uncertain time in real estate as certain forms of real estate dwindle and others prosper. The path moving forward is uncertain, while some things like housing and data centers will always be needed. It’s hard to say if office spaces will bounce back, or if industry will continue to be exported out of America. Real estate is a surprisingly complex issue, what matters, ultimately, is staying informed.

Source: ChessRealtors.com

Commercial Real Estate and its Altered Path

Brian Wallace

from WebProNews https://ift.tt/8qyw3Mn

No comments:

Post a Comment