If you’re like most content marketers I speak to, the strategies and tactics you use to grow an audience and get attention just aren’t working as they once were.

A BuzzSumo study, Content Trends 2018, confirms it; in a review of 100 million articles published in 2017, the company found social sharing was half what it was three years earlier.

It’s time to look around for new ideas. One successful but often overlooked approach is publishing original research. I’m not referring to market research, customer research, or competitive research, I’m talking about how marketers host an original research project and publish the results of that effort. In other words, research as content marketing.

The concept of publishing research isn’t new. Consulting and technology companies have been doing it for decades. PwC’s annual Global CEO Survey – now in its 21st year – is an excellent example of a long-running, benchmark-setting study that influences decision-making. Yet research does not have to be as ambitious (and costly) as the PwC example. And, even more, research doesn’t have to be as wonky and traditional as a consulting firm’s business-outlook study.

There are now so many more options other than traditional survey-based studies, and much more creative ways to let your data-freak flag fly – from traditional and studious to quirky and even wildly creative. Let’s look at five options:

There are many creative options other than survey-based studies to let your #data freak flag fly. @clare_mcd

Click To Tweet

HANDPICKED RELATED CONTENT:

Traditional benchmarking surveys

When marketers think of original research, they’re generally thinking of the industry-changing benchmark studies, such as Freelancing in America – a study of the nature of freelance work, produced by Edelman Intelligence, in collaboration with Upwork and the Freelancers Union. The survey, conducted every year, charts the size of the freelance economy and defines the conversation about how freelancers will upend the nature of work in America.

Short-form surveys

Survey-based research need not be long and complex to be interesting and influential. LendEDU, a loan refinancing company, publishes monthly short-form studies on particular (and amusing) topics, such as: What would Americans do for a 10% raise? The company posed 10 imaginary scenarios to survey takers, including giving up all social media accounts for the next five years (54% picked that option).

Survey-based #research need not be long & complex to be interesting & influential, says @clare_mcd.

Click To Tweet

Analyses of owned data

Many companies have access to anonymized user data to report interesting insights (tech companies and online retailers are most likely to be sitting on data treasure troves). Oh My Green, a company that stocks office kitchens with snacks and drinks, published its most popular flavored LaCroix water. While the concept may seem oddly boring, the simple study was picked up by sites like the Kitchn and generated significant buzz for the food startup.

.@OhMyGreenHQ uses sales data to report interesting insights – like most popular flavor of LaCroix. @clare_mcd

Click To Tweet

Analyses of third-party data

When Orbit Media, a web design and development company, wanted to get attention, the company did something that was relatively simple. It chose the top 50 marketing and advertising companies in the world (as defined by Alexa), and then judged each company’s website based on 10 web design standards. The results were published in a blog post called 10 Best Practices on the Top 50 Websites. That single blog post has generated hundreds of backlinks since it was posted in 2015. (Backlinks are one of the key ranking factors in Google’s algorithm, signaling a site’s credibility and authority.)

HANDPICKED RELATED CONTENT:

Simple polling

Perhaps you’re a data wonk but really don’t feel all that ambitious about original research. Why not launch some short polls to take your audience’s temperature about key issues? Or poll your coworkers as part of an employer branding project (Polly for Slack is an easy way to do this). Keep in mind polls generally don’t allow for knockout questions (e.g., disqualifying someone if they fall outside your target age range or income level) but are an interesting way to find out how a group thinks about a timely issue.

Polls are an interesting way to find out how a group thinks about a timely issue, says @clare_mcd

Click To Tweet

What type of original research are you publishing?

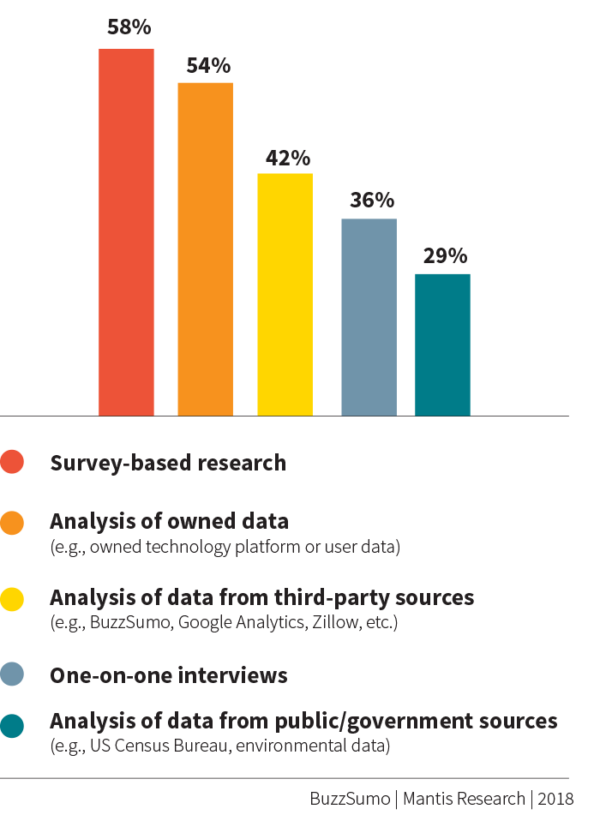

A 2018 study by BuzzSumo and Mantis Research explores marketers’ favorite research types. Not surprisingly, marketers use surveys more often than any other research type.

Research tech

These tools help marketers host surveys and analyze results. Keep in mind: Free tools are serviceable for simple surveys, but if you need to use knockout questions (e.g., questions that disqualify particular survey takers) or survey logic, or if you require advanced reporting, you’ll need to pay for a more robust solution.

HANDPICKED RELATED CONTENT:

7 deadly sins of original research

If you’re going to invest in original research, give yourself the best chance of success. Avoid the common mistakes that undermine too many research projects.

1. Spending too little time on strategy

Long before you jump in to conduct research, it’s critical to understand why you’re doing so and what you hope to gain. Asking the right questions can help you figure out what type of research project makes the most sense and what study areas will generate the most compelling stories.

2. Skimping on data science

The area where we see the most trouble is in the realm of data science — whether in poor survey design or erroneous data analysis. If there’s one place where you want to direct your marketing budget, data science is the spot. (And if your team has never embarked on research before, but is committed to a DIY approach, consider a smaller survey so you can get your mistakes out of the way without big repercussions … because you will make mistakes.)

If there’s one place where you want to direct your #marketing budget, data science is the spot. @clare_mcd

Click To Tweet

3. Ignoring sample size and representation

Know in advance the size of the sample you’re targeting. Remember, if you plan to study cohorts within your sample (e.g., men vs. women), the size of that cohort must be large enough to support credible analysis. Another big consideration is representation. Does your sample truly represent the group you’re aiming to study? For example: If you intend to save money by surveying your own audience, are you sure your audience accurately represents your target study group?

4. Neglecting to test your survey

I could fill many pages regaling you with stories about what can go wrong when you don’t test your survey (“testing” here means releasing it to a small group to complete and soliciting their feedback). Test. Your. Survey. It will save you time, money, and humiliation.

Test. Your. Survey. It will save you time, money, and humiliation, says @clare_mcd. #originalresearch

Click To Tweet

5. Talking about findings not supported by the data

The biggest no-no is confusing “causation” and “correlation” (sometimes called “association”). Just because there is a correlation between the number of bike riders and the number of seagulls in an urban area does not mean increasing bike ridership will cause a spike in sea-bird sightings. Beyond this common confusion of causation/correlation are many other errors of analysis. (Referring again to point 2 — don’t skimp on data science.)

6. Spending too little time on amplification

If you invest time and money in a research project, don’t shortchange it by ignoring your amplification plan. Your research — no matter how great — won’t be picked up without a rigorous amplification plan supporting it.

7. Assuming research is wonky and boring

My favorite research projects are hilariously funny, such as the Avocado Toast Index from the BBC. Don’t be afraid to proudly show off your nerd credentials.

Be sure to know your why

Before jumping in to try out any of these ideas, however, it’s critical to assess your goals. Are you looking for marketing-qualified leads? Then you need a meatier survey that’s gated (people will only share personal details if they perceive they’re getting substantial value in return). Is your goal to generate backlinks? Then a short survey or analysis of public data can meet your needs. Are you trying to fill up your content engine? If so, a monthly small-scope survey may work nicely.

Among the issues you will want to ponder: What will be your cross-variables – the ways in which you segregate groups within your sample to compare and contrast? These can be as simple as industry groupings or developing something like a beginner-intermediate-advanced continuum (among many other choices). If you decide on a cross-variable that is an average or score based on more than one response, be sure you can explain it in plain English.

Finally, think about how your research will dovetail with the other themes on your editorial calendar. We often find that clients want to take on comprehensive surveys but spend too little time thinking through how the results will generate a story rather than a catalog of facts. What will readers find exciting? Illuminating? What will they do with the findings? And how can you support the research findings with prescriptive content? Rather than a single shot, well-executed research is part of a portfolio of data-driven, credible, and entertaining content.

Think about how the research will dovetail w/ other themes on your editorial calendar, says @clare_mcd.

Click To Tweet

A version of this article originally appeared in the November issue of Chief Content Officer. Sign up to receive your free subscription.

Cover image by Joseph Kalinowski/Content Marketing Institute

The post 5 Research Options You May Never Have Considered for Your Content appeared first on Content Marketing Institute.

from Content Marketing Institute https://ift.tt/2P3pHx8

No comments:

Post a Comment