30-second summary:

- ClickZ and SEW hosted a virtual briefing, The Impact of COVID-19 on the Automotive Industry & Marketing with Trevor Hettesheimer, Manager, KPI’s, Analytics, Search & Planning at Volvo.

- There has been a sharp drop in automotive sales compared to the 2020 forecast in January, which predicted 16.8 million in total sales and 13.4 million in retail sales.

- As a result of nationwide shutdowns combined with an oil price war, automotive industry sales were down 41% in March 2020 compared with the previous year.

- To help mitigate the impact on its business, Volvo took inventory of their U.S. dealerships and assessed who could remain open for sales and service.

- They then assessed what dealers could do business online and brainstormed ways they could safely deliver cars or allow consumers in lockdown to have their cars serviced.

- Hettesheimer noted that the most significant drop in sales would likely be April at 60-80% below what was initially forecasted at the start of 2020.

- Based on the pre-virus forecast, Volvo decided to cut all planned media spend for April and May, except for paid search which is based on consumer intent. They audited their ad copy and messaging to ensure it made sense in the current business climate.

- Volvo is constantly monitoring the state of the economic recovery across the U.S to inform when they decide to relaunch their advertising.

- Hettesheimer summarizes four key steps that businesses can use to inform their marketing decisions: take inventory, review all messaging and adjust as appropriate, capture demand with search marketing, and take note of changing search behaviours and tailor content accordingly.

We recently hosted a virtual briefing as part of our new Peer Network series on the impact of COVID-19 on the automotive industry and marketing with Trevor Hettesheimer, Manager, KPI’s, Analytics, Search & Planning at Volvo.

Trevor has spent over two decades at Volvo US in a variety of different roles. He began his career as Volvo’s Global Marketing Analyst and helped to bring their first SUV to market, the award-winning XC90.

Hettesheimer currently focuses on reporting and presenting predictive analytics based on Volvo’s KPI’s. Hettesheimer is also responsible for Volvo’s paid search marketing and SEO activities in the US.

In the briefing, which is part of our new Peer Network initiative, Hettesheimer shares insights and data on how COVID-19 has dramatically changed business at Volvo.

The impact of COVID-19 on the automotive industry

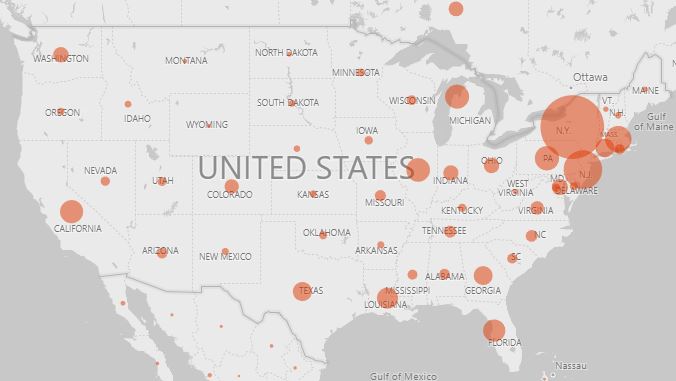

In order to understand COVID-19’s impact on business in the US, Hettesheimer and his team consult a key resource available from Bing, the COVID-19 Tracker, which provides real-time reporting on how the virus is tracking in the U.S.

“The coronavirus is truly a human tragedy at a global scale,”

says Hettesheimer.

“There are 2.1 million confirmed cases and growing worldwide, with over 144,000 deaths. This is really impacting every nation on the planet. From an economic standpoint, many economists agree that the world is facing the most serious challenge since WWII ended.”

Hettesheimer went on to note that while the government stimulus package of 2 trillion dollars will stem the initial economic tide of the virus, more money will soon be needed as the crisis drags on.

“As marketers, even how we’re working has seen drastic change,” says Hettesheimer.

“While Volvo is already an innovator in the automotive sector with a well-established remote working and distributed workforce even before the setup, we’ve never had 100% of our employees working from home at the same time.”

Volvo’s headquarters are just outside of New York City, which was still the epicentre of the virus at the time the briefing was recorded. Their factories in the U.S. and Europe temporarily shut down and this, combined with the remote work environment, has had a significant impact on the way Volvo has been approaching company collaboration and marketing. In looking at the automotive industry pre and post-virus, there has been a sharp drop in the automotive sales forecast.

2020 Pre-virus US Automotive Sales Forecast—Source: J.D. Power & Associates

2020 Pre-virus US Automotive Sales Forecast—Source: J.D. Power & Associates

The stock market crashed on February 20th after reaching record highs in early February and continued a precipitous drop through February 28th. Additionally, most global markets were impacted due to an oil price war between Russia and the OPEC nations led by Saudi Arabia. The lower oil prices threatened oil exporters like the U.S. with higher production costs.

As a result of this, automotive industry sales were down 41% in March 2020 compared with the previous year.

Impact of COVID-19 on Volvo’s marketing plan

The first step Volvo took in response to the virus, was to understand the scale and severity of its impact on their sales and service business. They took inventory of their dealerships and assessed who could remain open in some capacity for sales and who could remain open for service.

They found that, regionally, as many as 98% of Volvo’s dealerships across America were closed.

Volvo also assessed which dealers could continue doing business online for sales and looked at ways they could safely deliver cars to people or allow consumers on lockdown to get their cars serviced.

From there, they attempted to forecast sales in the new pre-pandemic landscape. They did this by looking at consumers’ ability to shop and at their finances. The assumption was that consumers who had the means to buy a car and the ability to leave their house to shop, would do so.

Volvo then attempted to determine the business impact of the virus through the end of 2020, designating four phases of retail sales assumptions as follows.

Using the above assessment, Hettesheimer noted that the most significant drop in sales would likely occur in April, with a potential drop in sales of 60-80% below what was forecasted at the start of 2020. The forecast for the remainder of the year was assessed as follows:

May/June: Second recovery phase where daily rates of new infections/death are at the peak or declining. Sales will still be down significantly, but at improved levels compared with March/April.

July through December: Third phase that will coincide with the consumer’s “new normal” – with infection rates/deaths significantly down and restrictions on businesses and consumers relaxing.

“Consumer behaviour will be changed for some time,” says Hettesheimer.

“Perhaps as a consumer or as a car dealer, you’ll think twice before getting into a car to perform service or buy a pre-owned vehicle.”

Impact of COVID-19 on search planning for 2020

Like many businesses, Volvo sought out ways to preserve capital in the current uncertain environment. The company tallied committed media funds versus uncommitted media funds and ultimately made large cuts to planned April and May media spend. This enabled them to control their profitability and cash flow in the short term as sales took a major downturn while enabling them to continue investing in the business over the long term.

Throughout April, all marketing channels are dark for Volvo at a national level, though there may be some local ads still running. There are two exceptions nationally.

- Channels where consumers come to Volvo based on intent (for example, search marketing)

- Organic social media properties

Volvo also assessed all in-market customer-facing messaging and pulled or edited ad copy and creative that did not make sense in the current environment. This included reviewing their website to make sure messaging matched current capabilities such as the ability to take a test drive.

Says Hettesheimer,

“We looked carefully at our language on the website. One of the big changes we had to make, for example, was that all the hours of operation had to be changed in our ‘Find A Dealer’ directory.”

Volvo also reviewed its in-market offerings to determine which ones worked better online versus at the dealership, like the Volvo Concierge Program. This is an online chat service providing white-glove services for Volvo shoppers and customers that enable them to chat with a call centre person live, 24/7.

Volvo Concierge Home Page

Volvo is trying to anticipate when dealers will open again—and when consumers will start shopping for cars—by monitoring the state of the economic recovery across the U.S. This will inform when they decide to relaunch their advertising.

They do this by looking at a variety of data sources including Google Analytics, Google Trends, Institute for Health Metrics and Evaluation (IMHE) COVID-19 projection models, and state-by-state school closure updates.

Steps businesses can take to survive a global pandemic

In looking towards the future, Hettesheimer summarizes four key steps that businesses can use to inform their marketing and business decisions as follows.

- Take inventory—Use available data and resources to understand how your specific business will be impacted over the short, medium and long terms. Then apply financial analysis to help understand the impact on profit and cash flow.

- Review all advertising and marketing materials including paid ads and publicly available content (e.g., your website) and adjust the content, as necessary.

- Capture demand with search marketing.

- Take note of changing search behaviours and tailor content/ads accordingly.

“Be sensitive,” advises Hettesheimer. “Your customers are hurting right now. Let them know you’re there for them when they’re ready. If you can offer special financing or help them through a rough patch, do so, and make sure you mention that as well, but be humble.”

You can register to view the free on-demand briefing, “Impact of COVID-19 on the automotive industry” on ClickZ. You can also apply to join our Peer Network, a peer-peer networking forum for senior marketers.

The post Volvo’s Trevor Hettesheimer talks about how COVID-19 has changed automotive business appeared first on Search Engine Watch.

from Search Engine Watch https://ift.tt/2RYh2QL

No comments:

Post a Comment