For several years, the search term ‘payday loans’ has regularly attracted more than 200,000 searches per month on Google.co.uk. Whether providing loans or generating leads, the payday loans industry has notoriously been big business and at its peak, was estimated to be worth around £2 billion per year.

Because of this, the top positions on Google’s SERPs for ‘payday loans’ have been a hugely lucrative and sought-after search term; and subsequently was dominated by SEO professionals using massive manipulation to hack their way to the top of the search results.

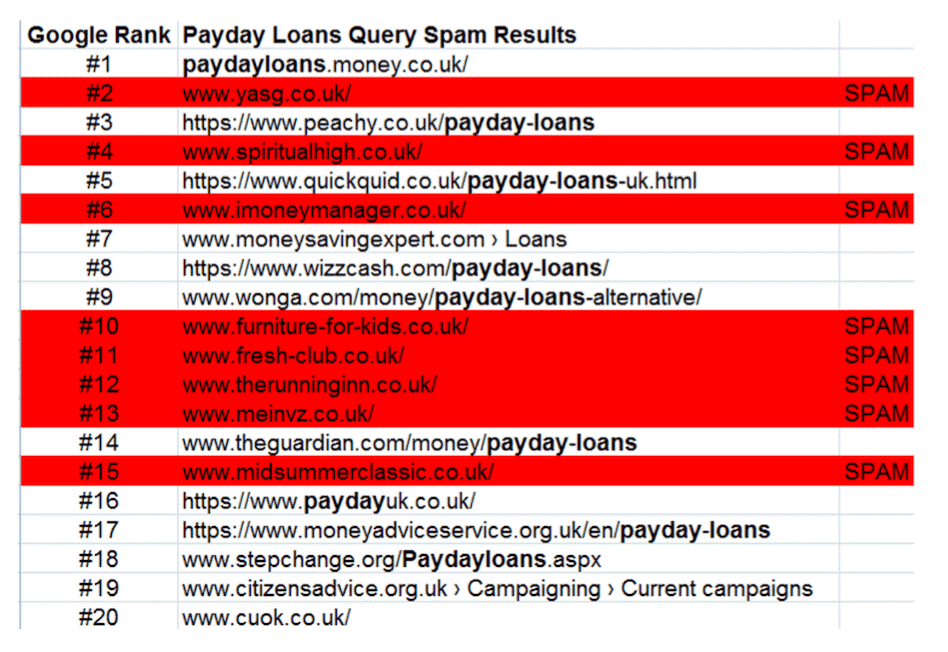

Until 2013, page one for payday loans barely listed a real payday loan company. Instead, the listings were made up of ‘hacked sites’ including bicycle sales, women’s magazine and frankly, just random domain names that once clicked on redirected to a dubious data capture form.

Introducing the payday loans algorithm

With customer data at risk and a mountain of complaints from UK consumers (and similar results in the US), Google reacted and introduced an official “payday loans algorithm” in June 2013. For the search giant to acknowledge a particular search term – demanding its own algorithm and focusing on a micro-industry across the pond – it was certainly out of the ordinary and we are yet to see any other industry treated in the same regard.

The payday loan algorithm update was rolled out over a two-month period. The first payday loan update occurred in June 2013, followed by Payday 2.0 on 16 May 2014 and Payday 3.0 which was rolled out shortly thereafter in June 2014.

Whilst the first algorithm change was a general clean up, payday loans algorithm 2.0 focused on targeting spammy queries, abusing Google+ accounts, doorway and hacked websites. Payday loans 3.0 was geared towards tackling spamming links including links of low quality, reciprocal links, forums, blog networks and websites which require paid submissions in exchange for a link.

Soon after the rollout of Payday 3.0, the search results were essentially cleaned up and have since been a much clearer representation of how rankings for payday loans should be by showing legitimate companies.

Those websites that were targeted by changes in the algorithm were subsequently penalized from Google searches, which included dropping 10 pages or even off the face of Google altogether. There were a handful of sites that had previously dominated the SERPs and then ceased to maintain any online real estate including Tide U Over and Red Wallet.

Bringing payday to today

The payday loans business took another drastic change following the introduction of FCA regulation in January 2015. Whilst the industry remains lucrative, the number of companies’ active has diminished significantly in the last three years – from 200 lenders to around 40 and originally hundreds of comparison sites to around a dozen. Margins have been hit by the introduction of a price cap, keeping the daily interest at a maximum of 0.8% and tougher regulation on the selling of data – leading to much higher operating costs and barriers to entry.

While there have not been any additional releases of the payday loans algorithm, Google is still keeping an eye on it and even implemented a ban on PPC ads for payday loans in 2016. The outcome was far stricter in the US than in the UK where lenders and comparison sites can still show paid ads but are required to show proof of their regulatory license to Google before going live.

How to successfully rank for payday loans in 2018

Fast forward to 2018 and there are 10 legitimate companies ranking in the top 10 for ‘payday loans’ in the organic search on Google.co.uk.

Our SEO company has successfully ranked five of the websites that are currently positioned in the top 10 and based on the success we have seen, we have identified some of the main trends below, which seem to be very specific to a payday loans algorithm and differ to the techniques used for ranking for other keywords in loans and insurance.

Direct lenders win over comparison websites: All websites positioned in 1 to 10 are essential providers of payday loans, known as ‘direct lenders’ and not comparison websites. While the main comparison sites in the UK dominate the search results for things like life insurance, car insurance and personal loans, none of these companies come near the top 3 pages for ‘payday loans’ despite all having a landing page to target this keyword.

In positions 1 to 20, there is only one comparison website that features all the lenders and we are responsible for their SEO. However, their homepage resembles a more direct lender with a calculator and apply now button versus a comparison table format.

Brands win over exact match or partial match domains: There is no website listed in the top 10 that has the word ‘payday’ in their domain, suggesting that Google prefers to see brands over exact match or partial match domains. Compare this to other industries where logbookloans.co.uk ranks first for ‘logbook loans’ and two companies ranking on page one for ‘bridging loans’ that include the main keyword in their domain name.

Keeping in line with the brand theme, sites that rank well will have quality traffic from several sources including direct, paid, social and email. To benefit their SEO, the users should have high engagement rates, high average time on site and low bounce rates. This can be hugely beneficial for search rankings but is not an isolating factor. Companies such as Sunny and Lending Stream advertise heavily on TV and will generate good direct traffic as a result, but their lower search rankings do not correlate with enhanced direct traffic.

Domain age less relevant: Whilst several industries such as car insurance use the age of the domain as an important ranking factor, this seems to be less relevant for payday loans. Notably, 3 of the top 5 that rank (Cashfloat, Drafty and StepStone Credit) are less than two years old. This could be attributed to accumulating less spam and a history of low-quality links compared to much older domains.

Links still win… domains with more links tend to outrank those with fewer links. Interestingly, around 7 of the top 10 seem to have similar domains linking to them, suggesting there are some links that Google clearly values in this industry. However, finding the balance here is key as some of these similar links have a very low DA and spammy link history. Understanding which will work well will be the difference between better search positions or a penalty.

Strong user experience: A strong UX making it clear where to apply for a payday loan is proving to be more effective than providing thousands of words explaining what payday loans are. Keeping in line with user intent, successful websites are making use of calculators, images and videos to drive the application and not provide thin content.

Room for alternatives: Two sites currently in the top 5 for payday loans are offering alternatives (StepStone Credit and Drafty.) This could highlight Google’s moral obligation to offer a variety of products and not just high-cost short-term loans, thus alluding to whether they are in fact manually organizing the SERPs themselves.

To conclude, the usual SEO techniques of brand building, link acquisition and good user experience still apply to rank well in a modern payday loans algorithm. However, there is no doubt that payday loans in 2018 still requires a very specific approach; which can be achieved by looking at the sites that rank successfully and getting a feel of what content they write and what links they get.

In an ideal scenario, we should see MoneyAdviceService ranking top of the tree since it has the most authority and has numerous links from every single payday loans company in the UK – but as they sit on page 3 and have for some time, this is proof that the beast of ranking for payday loans surely has a mind of its own.

from Search Engine Watch https://ift.tt/2IZjZ09

No comments:

Post a Comment