As Google has scaled up its Shopping products in recent years, there has been a growing consensus in the retail search marketing space that Shopping ads are one of the most effective ways to win valuable consumer clicks.

This is especially true of the non-branded, broader search terms that are typical of the early stages of the customer journey.

During this phase, Google Shopping ads – commonly referred to as Product Listing Ads, or PLAs – are considered to be a key means of engaging consumers early, and boosting new customer acquisition.

If the trends that we are currently seeing continue, 2018 will be a year of increased investment in Google Shopping ad formats across product-based search.

While text ads are still the most popular advertising format in many categories, retail-specific categories tell a very different story, with spend on Google Shopping ads far outstripping text ads in retail categories.

A new study by AI-powered search intelligence platform Adthena, analyzing 40 million search ads from more than 260,000 retailers, has shed light on the extent to which Google Shopping ads have come to dominate retail search marketing.

In this piece, we will look at some of the key findings from the report, explore the causes of Google Shopping’s phenomenal expansion, and consider what retailers can do to “future-proof” their search marketing strategy against upcoming shifts in the market.

Content produced in collaboration with Adthena.

The growth of Google Shopping

The Google Shopping ad unit has evolved considerably over the past few years, with increased attention and prominence afforded to Shopping ads in the search results page. This has resulted in a rise in clicks and impressions that has fueled the growth of Google Shopping ads in retail categories.

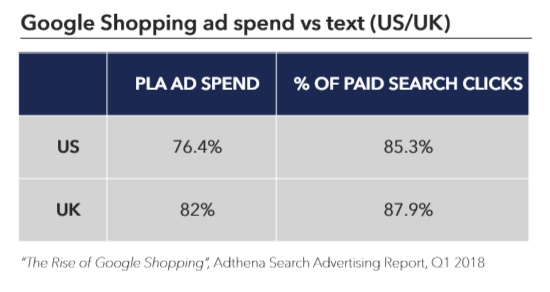

As of Q1 2018, Google Shopping ads are driving 76.4% of retail search ad spend in the US, and 82% of retail search ad spend in the UK – an overwhelming majority in both instances.

Adthena’s research found that in the US, this 76.4% of search spend was responsible for 85.3% of all clicks on AdWords or Google Shopping ads between January and February 2018. In the UK, the 82% of retail search ad spend invested in Google Shopping ads was responsible for 87.9% of clicks.

These figures confirm that Google Shopping ads are still offering good value to retailers in terms of spend/click ratio, and suggest that the value of Google Shopping ads has not (yet) reached saturation point, with room for growth in some key areas.

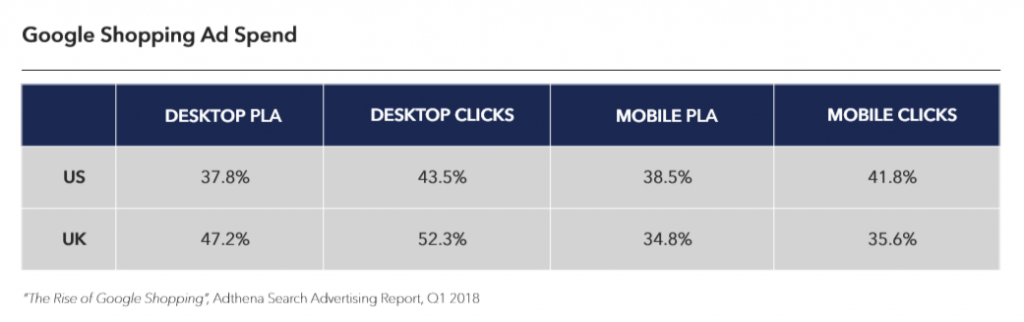

Mobile is one of these: according to Adthena’s research, although shopping ads on desktop generate a slightly greater share of clicks, Google Shopping ad spend on mobile now matches that of desktop, supporting evidence that mobile search is serving as a crucial touchpoint for product purchasing decisions.

Presently, Google Shopping ads on mobile are driving 79% of device ad spend in the US, and win 87.9% of clicks. With Google shifting more and more emphasis onto mobile search, this is likely to become an increasingly important area for retailers to invest in, and we may yet see these numbers grow further.

However, how much longer can Google Shopping continue its rise before the market eventually becomes saturated? To answer that, we need to understand what has fuelled Google Shopping’s dominance of the retail search market in the first place.

What is fueling Google Shopping’s retail dominance?

Ashley Fletcher, VP of Marketing at Adthena, believes that prominence and reach are the two key factors that have driven the rise of Google Shopping ads in retail search marketing.

Google’s introduction of a carousel for desktop Shopping ads in October 2016 was the first major change which gave increased prominence to Google Shopping ads. Since then, the ad unit has only developed further, with even more different formats for advertisers to benefit from.

“The unit has evolved both in terms of prominence on the page and in terms of ad features,” says Fletcher. “It’s also very rich in content – particularly on mobile – with multiple variants of the unit available to advertisers.”

In the US and the UK, the number of ads in the desktop carousel has even doubled as of February 2018 to surface 30 paid listings. This may go some way to explaining the particular dominance of Google Shopping ads in the US and UK – as we saw from the statistics in the previous section.

Then there’s reach: as Fletcher explains, in the past year, Google Shopping Ads have begun influencing users higher up the purchase funnel through far broader terms, appearing for much more generic product searches than before.

“In the last year, Shopping ads have started to trigger on a lot of the upper-funnel, generic terms – like “red dress”, or “black dress”. This is really driving users into a brand experience around those generics: it encourages the user to start drilling into those terms, and conduct longer-tail keyword searches off the back of that.

“These are very high-volume terms, keywords with a lot of traffic – so mastering that could be a challenge for search marketers, but you now need to be present at the top of that funnel, as well.”

While these developments have spurred a huge surge of growth in Google Shopping ads over the past two years, Fletcher believes this expansion won’t continue for long.

“In 2018, we’ll get closer to saturation point,” he says. “I don’t think there’s much room for further growth.

“Then I think we’ll get into the space we were in with text ads, where advertisers will be limited on spots, margins are going to be squeezed – meaning CPCs are going to increase – and it will come down to marginal gains: how can you optimize performance, as growth slows down?”

What can retailers do to get the most out of their ad spend in that environment?

“First and foremost, being able to manage at scale is a must-have,” says Fletcher.

“Secondly, master your categories. If you are a retailer, then knowing that you’re winning in – for example – men’s board shorts, and getting down to that level of knowledge with your categories, is essential.

“If you don’t do that, then you’ll have a very blinkered view of what’s going on.

“If you’re a department store retailer, for example, and your products reach more than 200 different categories, there is a dependency on knowing how well you’re performing in each of these categories. You’re going to have different competitors in each one: the challenge is knowing that, and making sure you are still winning there.”

Adapting for the future of search marketing

The rapid uptake of Google Shopping ads as the most significant part of retail ad spend budgets reveals how quickly search marketers adapt to new formats and opportunities.

As search advertising practices continue to change and new formats are introduced, advertisers will need to maintain this agility in order to keep ahead of the game.

“Google Shopping can be quite daunting for some advertisers when they take their first steps into it,” says Fletcher. “But if you do that with enough research, and enough context about what’s going on in each of your retail categories, you’ll have a far better chance of surviving.

“If you don’t follow the trends, adopt early, and understand these channels, you will get left behind.”

Amazon Shopping, for example, is a growing force in the retail search landscape which Fletcher believes will only play a bigger role in years to come, threatening to erode the dominance that Google Shopping currently enjoys.

Even as they take steps to future-proof their search marketing campaigns in the realm of Google Shopping, search marketers should investigate the opportunities presented by Amazon, in order to ensure the longevity of their search marketing strategy going forward.

For more insights from Adthena’s study and analysis of 40 million search ads, click here to download Adthena’s Q1 2018 search advertising report, The Rise of Google Shopping.

from Search Engine Watch https://ift.tt/2GwrIlv

No comments:

Post a Comment